Unless you’ve been doing business under a rock these past few years, you’ve likely heard about Bitcoin (BTC), a type of digital currency that eliminates the middlemen (i.e. governments and financial institutions) and allows parties to transact directly with each other. That, coupled with the fact that you can use Bitcoin to purchase goods and services anonymously, makes BTC an attractive payment option for a lot of people.

And if you’re like most ecommerce merchants, all the chatter around Bitcoin has prompted you to ask questions. Should you start accepting Bitcoin payments? How do you do it? What’s the future of Bitcoin?

We’ll answer all that (and more) in this guide. By the end of it, you will have a solid understanding of BTC and a clear idea of how you can make it work in your store.

[toc]

Let’s dive in.

Why should ecommerce merchants care about Bitcoin?

Bitcoin has many benefits, but for ecommerce stores, the three biggest advantages are a) BTC is chargeback-proof; b) there are zero to low transaction fees associated with Bitcoin; and c) accepting BTC makes business more attractive to certain types of customers.

No chargebacks

Unlike credit card transactions, Bitcoin transactions are irreversible. Once the funds have been transferred, the party that sent the payment cannot retrieve them without the merchant’s consent.

This eliminates your chargeback costs, and it makes harder for people to commit ecommerce fraud.

Zero to low transaction fees

As mentioned previously, Bitcoin is unregulated by governments and financial institutions. Transactions take place directly between the buyer and seller, so there are no middlemen to put holds on your funds and, more important, the fees (if any) for processing BTC payments are lower compared to those for credit cards.

“An e-commerce site can find a trustworthy BTC processor for as little as 0% for low sales volume up to 1% for higher volume sites,” said David Cox, CEO & Founder of LiquidVPN.

“That is one reason I think BTC or another blockchain currency will become the primary engine driving e-commerce forward in the undeveloped marketplaces of Asia and the Middle East.”

BTC helps you reach more customers

Accepting Bitcoin enables merchants to widen their customer base. A growing number of consumers are starting to use BTC to purchase goods and services, so you accepting the digital currency could be just the thing to set you apart and get them to choose you.

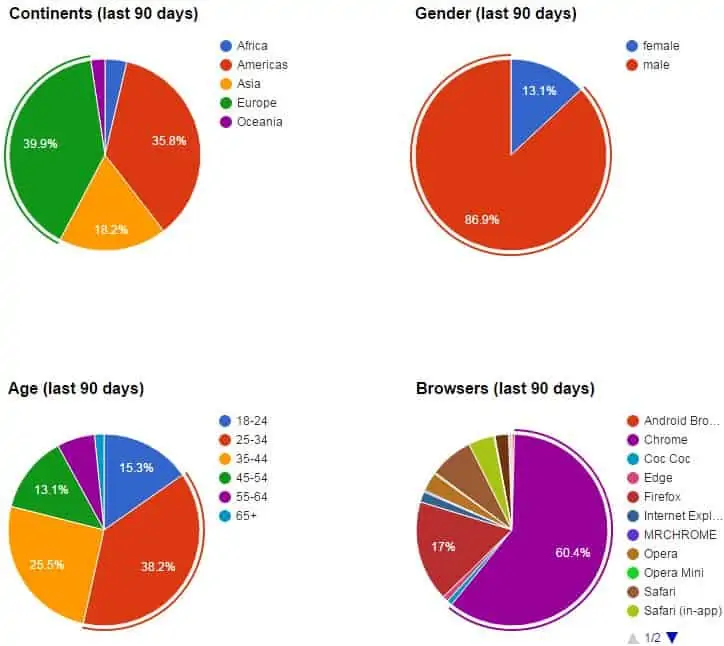

To be specific, majority of Bitcoin users seem to fall between ages 25 to 44, and are predominantly male. But we can expect these demographics to broaden as Bitcoin adoption continues to grow.

To illustrate this, below is a chart showing the demographic information of users who visit bitcoinx.io (later acquired by bitcoin.com).

What are the disadvantages of Bitcoin?

We’ve talked about the pros of accepting Bitcoin, now let’s dive into the some of the reasons why some merchants might not want to take it:

Volatility

Bitcoin is market-driven. And since it’s still a relatively young currency, its value can be volatile. If you’re risk-averse and aren’t fond of uncertainty, Bitcoin payments may not be for you.

However, it’s important to note that you can easily convert Bitcoin to your local currency. If you’re uneasy about market fluctuations, you can just choose to sell your Bitcoin quickly instead of keeping it in your wallet.

Too much focus on the currency

Bitcoin is quite novel, so if you start accepting it, expect many questions and conversations around the currency itself (versus your products). As Jad Mubaslat, Founder and former CEO of BitQuick.co, a leading US based Bitcoin trading platform, put it, “you may have customers inquiring how Bitcoin works out of curiosity.”

Adam Sah, co-founder of Buyer’s Best Friend said it best when he told Forbes that “the number one downside to Bitcoin is all the conversation.”

“I’m here to sell food,” he noted. “When customers walk in, I want them to pay in Bitcoin, yes, because I need to have the money to pay my suppliers. But I really want them to talk about chocolate or balsamic vinegar, not how they pay.”

Accepting Bitcoin on your ecommerce site

So, now you know a bit more about Bitcoin. At this point, you may even be considering accepting the currency on your site. Here are the steps you should take to start taking BTC payments:

Turn to your ecommerce platform

If you already have an ecommerce site, you can quickly get started with Bitcoin by integrating your store with a BTC payment processor. Most ecommerce platforms already have existing integrations, which makes setting up Bitcoin payments much easier.

Ecommerce merchants using Magento, for example, have options such as BitPay, CoinGate, and more. Meanwhile, Shopify store owners can use Coinbase, Dwolla, BitPay, or GoCoin to accept BTC payments.

Do your research to see what your options are. For some ecommerce platforms, finding a Bitcoin processor could be as simple as searching for an integration in the platform’s marketplace (this is the case for Magento.) In other cases, you may need to peruse the help documents of your ecommerce platform to find out how to accept Bitcoin payments (as with the case for Shopify users).

When in doubt, talk to your ecommerce solution provider directly. Get in touch with your account manager and get the full details about how you can integrate your store with a Bitcoin payment processor.

Evaluate different solutions

The next step is to evaluate the different BTC payment processors out there to see what works best for your store. Here are some factors to consider:

Transaction fees – Ask about the transaction fees charged by the Bitcoin payment processors you’re considering. As mentioned earlier, Bitcoin transaction fees are lower than credit card fees, with most providers having rates as low as 1%.

Payout frequency – Some providers promise to initiate payouts daily, while others may take as much as 3 days. If payout frequency is important to you (for example, if you must pay charges related to purchases that may build up quickly on busy days), make it a point to discuss it with your processor.

Supported currencies – See to it that your Bitcoin payment processor supports the payout currency you prefer. Most solutions enable merchants to withdraw Bitcoin payments in US Dollars and GBP, but if you’d like you’d like to withdraw your funds in a different currency, be sure the provider supports it.

Supported countries – Some Bitcoin payment processors cannot serve businesses from certain nations, so see to it that your provider supports the country that you’re doing business in.

Customer support – If you have a lot of questions or feel that you’ll need help with setting up BTC payments, look into the customer support offerings of your payment processor. Do they offer phone support or is everything done via email? What about live chat? Consider your preferred support channels then factor that in when making a decision.

Other ways to accept Bitcoin

Integrating a Bitcoin payment provider is the simplest way to accept Bitcoin on your ecommerce site. If a direct integration isn’t possible, though, you can explore options such as:

Payment buttons – Some Bitcoin payment processors will allow you to add a payment button to your website. Coinbase, for example, has a button generator that lets you do this easily. You can also use the Coinbase API to create your Bitcoin buttons.

Custom integration – Speaking of API, if you know a web developer and can’t find a Bitcoin solution that directly integrates with your shopping cart, you could go the custom integration route. Several providers have API documentation that enables you to do this.

Invoices – Another option is to use invoices instead of shopping carts. The process for creating invoices will depend on your Bitcoin payment provider. For GoCoin, you can tap into its API to create invoices; Coinbase, on the other hand, has an invoice generator tool.

You may also want to check with your current invoicing solution to see if they support Bitcoin payments (or if they have any workarounds for the cryptocurrency). QuickBooks customers, for example, can take advantage of Intuit Labs’ Pay by Bitcoin solution.

The invoicing and payment process will vary depending on the merchant. Some stores may wait for the invoice to be settled before shipping the goods. Others may choose to implement terms such as Net 30.

If you do decide to go the invoicing route, figure out what works best for your business and go from there.

Workarounds – If you can’t make Bitcoin work using integrations, buttons, or invoices, you could choose to find a workaround instead. Maybe it entails asking the customer to get in touch with you directly to purchase using BTC. Perhaps you can ask shoppers to leave a special note at checkout (for example some marketplace sellers do this; you may see it on sites such as Etsy).

Keep transactions safe and secure

Once you’ve decided on a Bitcoin payment processor and have set up your system, you’ll want to ensure that all transactions on your site — as well as your funds — are secure. Here’s how:

Stay on top of updates – Don’t neglect your software updates. See to it that you’re always using the latest version of the Bitcoin wallets, apps, or solutions you have so that you can stay up-to-date with security and stability fixes.

Use strong passwords and multi-factor verification – Protect your wallet by using a strong, hard-to-guess password (or better yet, a passphrase) that contains a combination of upper and lowercase letters, numbers, and special characters. If the solution that you’re using offers multi-factor verification (e.g. requiring you to enter a code sent via SMS or email), then take advantage of that security feature.

Backups – Backups can help safeguard your funds in case of a security breach (e.g. if someone hacks into your system or if your device gets stolen or broken into). For best results, Bitcoin.org recommends the following backup practices:

- Backup your entire wallet – Some wallets use many hidden private keys internally. If you only have a backup of the private keys for your visible Bitcoin addresses, you might not be able to recover a great part of your funds with your backup.

- Encrypt online backups – Any backup that is stored online is highly vulnerable to theft. Even a computer that is connected to the Internet is vulnerable to malicious software. As such, encrypting any backup that is exposed to the network is a good security practice.

- Use many secure locations – Single points of failure are bad for security. If your backup is not dependent of a single location, it is less likely that any bad event will prevent you to recover your wallet. You might also want to consider using different medias like USB keys, papers and CDs.

- Make regular backups – You need to backup your wallet on a regular basis to make sure that all recent Bitcoin change addresses and all new Bitcoin addresses you created are included in your backup. However, all applications will be soon using wallets that only need to be backed up once.

Consider cold storage – Cold storage is the practice of keeping an offline Bitcoin wallet. Doing so protects your funds in the event of a digital hack.

Don’t keep large amounts of funds in your wallet for an extended period – Remember, thieves can’t steal something that isn’t there. Make it a point to frequently transfer your funds offline or convert them to your local currency so you can have them in your (insured) bank account. If you need Bitcoin to run your business, then only keep what you need at any given time.

Lay out your policies and answers to frequently asked questions

Bitcoin is still quite new and novel, so you’re bound to come across questions and concerns from your customers. Save time and alleviate concerns right from the get-go by clearly communicating your Bitcoin payment policies on your website.

The specifics of your policies will, of course, depend on your business, but some of the factors you should think about are:

Payment procedure – Explain how Bitcoin payments work on your site. What are the steps customers should take if they want to pay with BTC? What information will they need to provide? Lay out the process as clearly as possible to reduce questions.

Overstock.com has a great page explaining how its customers can use Bitcoin on its site. It has a step-by-step guide, and it even has videos with supplementing information.

Refunds, exchanges, and returns – Will you allow customers to exchange or return items that were purchased using Bitcoin? What if someone asks for a refund? And how will customers communicate with you? Don’t forget, Bitcoin transactions are irreversible, which means dissatisfied customers cannot initiate chargebacks.

Have a think about how you will be addressing these things. Whether you decide to issue refunds in the form of BTC, local currency, or store credit/gift cards, lay out those processes as clearly as you can.

Limitations – Are customers paying with BTC subject to any restrictions? Are all your products and services eligible for Bitcoin payments? If not, be sure to specify which items aren’t available for purchase using BTC.

Newegg, for example, doesn’t accept Bitcoin for will call orders, digital gift cards, marketplace items, subscription orders, pre-orders, premier memberships, and return shipping labels.

Spread the word

Got your technologies and policies set up? Great. The next step is getting the word out. Accepting Bitcoin can help you tap into new markets, but those potential new customers won’t know about your business if you keep your initiatives to yourself. Here are some suggestions on how you can spread the word:

Display signs on your site – Get yourself a graphic that says something along the lines of “Bitcoin accepted here” and display it on your site.

For more images, check out the BitcoinWiki page on promotional graphics.

Get listed – Several Bitcoin directories enable consumers to find businesses that accept BTC. List yourbusinesss in these directories so you can put your business out there and drive traffic to your site. Here are a few of directories you can start with:

Alert your customers, friends, fans, and followers – You likely have existing customers or followers who are already using Bitcoin. Make sure they know that you accept BTC payments.

Send an email to your subscribers and schedule some socials posts announcing your Bitcoin initiatives.

Don’t forget about taxes

While Bitcoin isn’t regulated, and transactions are — to a certain extent — anonymous, BTC still has an equivalent in real currency. Because of that, it is still subject to tax. You need to keep a record of Bitcoin transaction and report your revenue to the government.

Your BTC payment processor may have the tools to help do this. Coinbase, for example, provides as “Cost Basis for Taxes report,” which summarizes your purchases and sales from digital currency, as well as your cost basis, capital gains, and loss.

You may also want to consult with a tax expert (ideally someone who has experience with Bitcoin). You want to ensure your taxes are filed properly.

Now, tax laws obviously vary, depending on your location and business type. But to give you a general overview, here is what the U.S. Internal Revenue Service has to say about digital currency and taxes:

Virtual currency is treated as property – The IRS treats virtual currency as property, which means the “general tax principles applicable to property transactions apply to transactions using virtual currency.”

Taxpayers must determine the fair market value of the virtual currency when reporting their income. – According to the IRS, “a taxpayer who receives virtual currency as payment for goods or services must, in computing gross income, include the fair market value of the virtual currency, measured in U.S. dollars, as of the date that the virtual currency was received.”

Taxpayers may have to deal with penalties if they fail to comply with tax laws – If you underpay your taxes or fail to report BTC transactions, the IRS may impose penalties and fines. That said, you may be able to obtain penalty relief if you establish “reasonable cause” for your failure to report on your taxes.

A look at online merchants using Bitcoin

Curious as to how Bitcoin transactions are carried out on other ecommerce sites? These examples should give you a better idea:

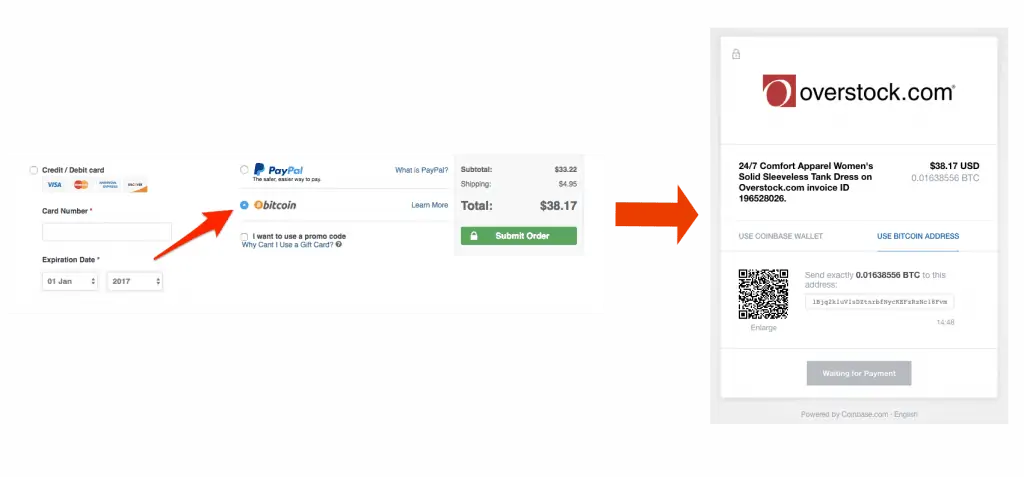

Overstock.com

Overstock.com is one the largest online retailers currently accepting Bitcoin. The site sells a wide range of products — from apparel and accessories to home goods — at cheap or discounted prices.

Shopping with Bitcoin is a smooth experience on Overstock.com. The site lists Bitcoin as a payment method on the checkout page, and users who want to pay using BTC would simply select that payment option and then click the “Submit Order” button.

Overstock will then launch an overlay popup instructing the customer to send a specific amount of BTC to Overstock.com.

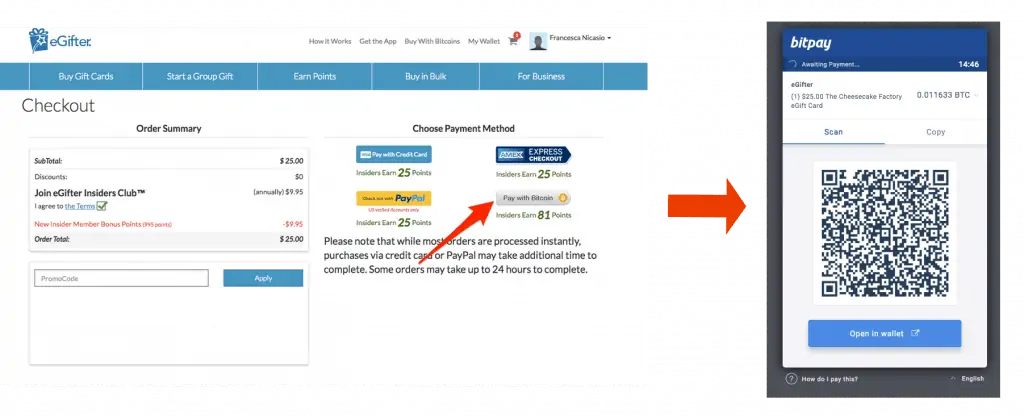

eGifter

eGifter.com, a website that sells premium branded gift cards, also accepts BTC payments. At the checkout page, customers will see a “Pay with Bitcoin” button indicating the BTC payment option. Clicking that button will launch a new tab (powered by Bitpay), and shoppers can pay by scanning the QR code or sending the funds to eGifter’s Bitcoin address.

Select Etsy merchants

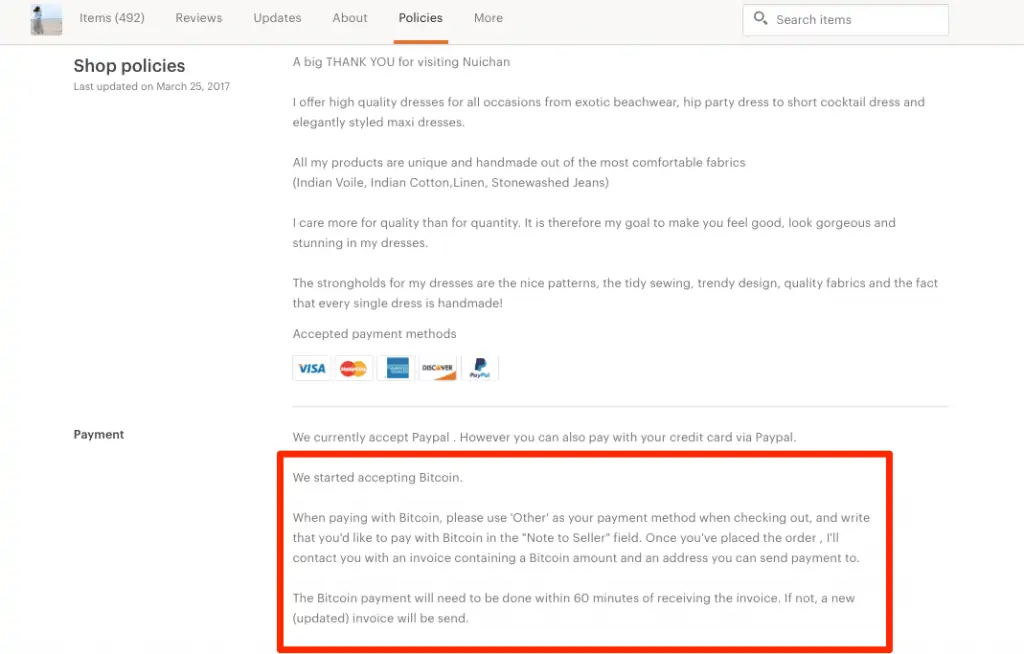

Etsy.com currently doesn’t have Bitcoin options for its sellers, but some merchants are using workarounds to serve shoppers who want to use BTC.

Take Nuichan, a merchant that sells women’s apparel. Shoppers paying for orders using Bitcoin must select “Other” at checkout and leave a note indicating that they’re paying using BTC. Nuichan will then send the customer an invoice along with a Bitcoin address.

So, what’s next?

Now that you have an understanding of Bitcoin and how it works for ecommerce merchants, it’s time to figure out what comes next. Will you capitalize on Bitcoin and start accepting BTC on your site? If so, the first step is figuring out how to make it happen.

Look into Bitcoin payment solutions that integrate with your ecommerce platform, and explore your options. Alternatively, you can also consider other ways to accept Bitcoin. These include invoicing, Bitcoin buttons, and other workarounds.

While you’re at it, educate yourself on how to safeguard your funds. Get a reliable digital currency wallet, and take the time to secure it through strong passwords, encryptions, and backups.

Bitcoin resources

It also never hurts to keep Bitcoin resources handy. In addition to this guide, explore the support and educational offerings of your payment provider, so you’re always in-the-know with Bitcoin developments.

Other Bitcoin resources that you could look into include:

The future of Bitcoin

There’s no way to ascertain the future of Bitcoin, but many experts are optimistic about the digital currency.

“It’s still difficult to predict if Bitcoin will become a popular payment method,” said Mubaslat.

“For consumers, they enjoy the reversibility of credit card payments, putting the merchant at a disadvantage. However, I expect that the number of individuals using Bitcoin for ecommerce will continue to grow as adoption continues, especially in 3rd world markets. Integrating Bitcoin provides virtually zero downsides for merchants, and can only provide an expanded customer base.”

Bottom line

Whatever your views on Bitcoin are, no one can’t deny the impact that it has had on the ecommerce and payments industries. Whether or not you decide to accept BTC in your business, you should, at the very least, keep yourself informed about the ins and outs virtual currency.

Bitcoin image credit: Davidstankiewicz