The market for financial products and investors to fund ecommerce startups has grown enormously over the last few years. Many of these are focused at the ‘scale up’ stage: Ie, well proven businesses, with 3 or 4 years in their history. Clear Angel, from ClearCo is one of a growing number of options focused on *early* stage businesses: Your business could be 3 or 4 years old, but it does not have to be.

Clear Angel is basically the ‘early stage’ funding product from ClearCo, the company previously known as ClearBanc, who claim to be the world’s largest ecommerce investor, with $1.4bn invested in more than 5,000 ecommerce businesses. Their product range currently consists of ‘ClearAngel’ (what we’re focused on in this review), ‘ClearCapital’, for later stage ecommerce businesses, designed to fund marketing and stock essentially, and ‘ClearRunway’, designed for SaaS companies and other startups to fund general growth. Across all of that, they offer three areas of functionality alongside funding:

- ClearInsights – benchmarks of your metrics against other companies. (as they’re 100% ecommerce across two of their funding products, they have access to plenty of data)

- ClearValuation – a business valuation feature. This presumably allows them to intro you to potential exit partners. It’s not clear whether they take intro fees for that from those partners, but either way that could be a valuable service.

- ClearPartners – access to their network of agencies, platforms and other services like lawyers & accountants.

Clear has two co-founders:

- Andrew D’Souza – a former McKinsey analyst who worked through a handful of startups before founding Clearbanc (the prior name for Clear) back in 2015.

- Michele Romanow – a serial startup founder, who sold a prior biz to Groupon shortly before joining Clearco as co-founder.

The backstory on ClearAngel is essentially: Clear was funding established ecommerce companies. After running successfully for a few years they took a look at their data, who they were funding, who they were not, and realised they had essentially a blind spot for early stage companies: They’d turned away 50,000 early stage companies due to lack of data. So they decided to build a product specifically aimed at those companies, opening up to a whole different range of merchants.

Theoretically that works well for them (they cover their risk through fees, and open up a great pipeline of future customers for their products for more established biz), and theoretically it works great for early stage ecommerce companies: They get access to funding, and automated assistance, without having to give away equity.

The Clear Angel Pitch

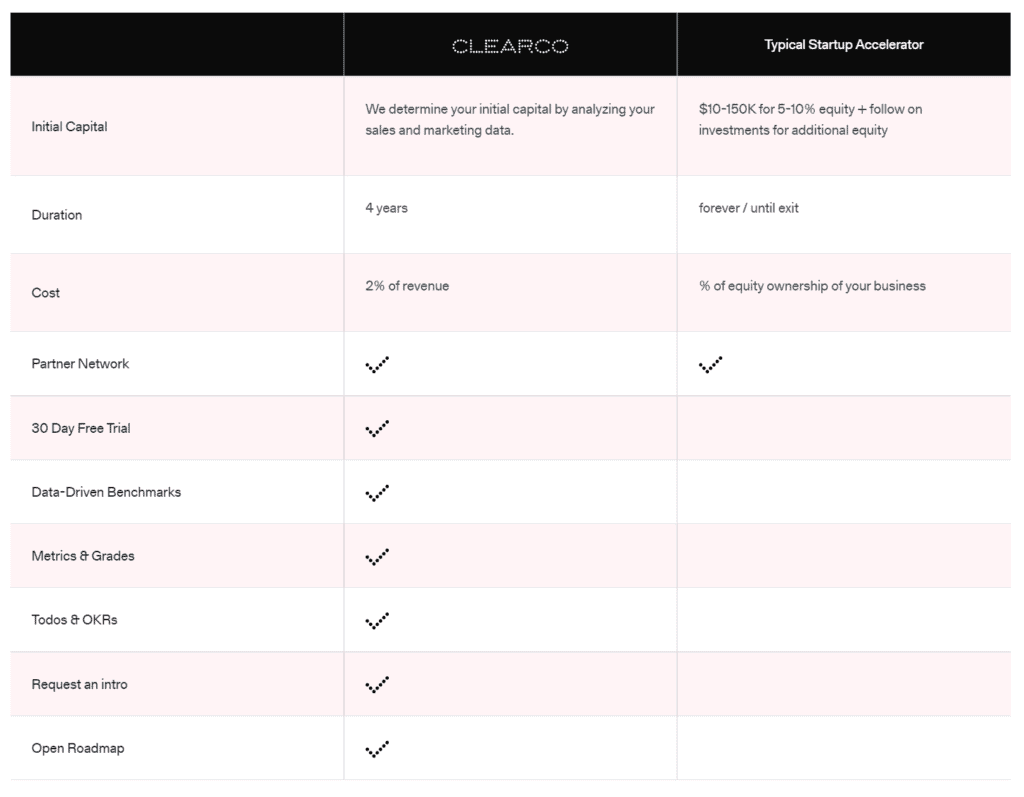

The pitch is it’s basically an alternative to an angel investor, or to a startup accelerator. Of course, there are big differences between this an an angel investment, or a startup accelerator. Some of those you may perceive as being worse, but some you may think are better.

For example: Some businesses prefer to avoid angel investors due to the control they may try to exert on strategy or on a potential exit. On the other hand, some like angel investors, or startup accelerators, as they offer access to a network. In that respect, Clear have put some things in place to try and bridge that issue: their ‘platform’ allows you access to lawyers, agencies, buyers, and also ‘advice’ in the form of data-driven guidance that tells you things like your average order value being off track, or your conversion rate needing to be fixed.

How much does Clear Angel allow you to access?

It’s aimed at companies looking for between $10-$25k initially. As you grow, you can access more money as needed, as Clear have a full suite of products for growing businesses. This is – essentially – the equivalent of ‘Angel’ funding, aimed at helping businesses get to the next level, at which stage you may be ready for and looking for additional funds.

How is this different to an Angel Investor?

Perhaps the biggest difference in choosing Clear Angel vs a traditional angel investor is that Clear do not take equity in your business. Instead, you are doing a deal with Clear whereby they will take 2% of your revenue for the next 4 years, rather than giving them an actual percentage in your business.

In other words, if you sell your business for $10 million in 4 years time, you will not owe Clear $200,000 (2%), instead you will simply have paid them 2% of revenue each year.

In finance terms, that’s what’s referred to as ‘non-dilutive capital’. Ie, the funding does not dilute your equity in your own business.

From Clear’s point of view, there is of course risk in that: Perhaps an unknown event will occur, putting you out of business. In that respect it is similar to traditional angel investment. On the reverse of that, there is opportunity for great gain on Clear’s side too:

Let’s say your revenue is $10k in year one, $100k in year 2, $1m in year 3, $2m in year 4 following the ‘investment’, that means you’d pay Clear:

- Year 1: $200

- Year 2: $2,000

- Year 3: $20,000

- Year 4: $40,000

Therefore they’d make back $62,200 on their $10-25k ‘investment’. On the other hand: If your goal is to exit, at ‘Year 4’ above you may seek to sell the business for (say) $5m. If Clear had taken 2% of your equity, that would mean their stake would be worth $100,000, and your $5 million would drop to $4.9 million. If an angel, or startup accelerator, had taken 5-10% of your equity, you would ‘lose’ $250,000-500,000 in equity, rather than $62,200.

Why is it called ‘Clear Angel’?

As mentioned, Clear pitch this as an alternative to angel investment, or to a startup accelerator. In that respect, it’s worth thinking about what you’d get with angel investment & what you get with Clear.

A good angel investor can act as a mentor, or equivalent to a board for your business. That’s amazing if you get the right person, in the right context. They can open doors to their network, can help to guide you, can perhaps even link you up with future capital if you need it.

On the flip side of that, an angel investor of course wants their investment returned. That may be an added burden to you mentally, in the instance they do become a valuable ‘friend’. It may also be a burden financially: It’s not unusual for an angel investor to want a specific high return on their money. They may therefore push you to take the business in a direction you do not wish, or at a speed you’re less comfortable with, in order to achieve their return.

The elements that Clear Angel pitch as being similar to angel investment are:

- Their AI dashboard, tailored for ecommerce companies, that gives you updates on where your business is at, and any KPIs you need to pay attention to and fix.

- They can give you ‘personalised’ intros: To agencies, to freelancers, to accountants, to lawyers, and even to other investors. (In fact, because their systems know about your business, they give you a ‘likelihood of success’ rating for intros to VCs and other angels)

- Their system attempts to guide you toward your overall goals, as well as your business goals. Eg, you can tell them you’re looking to cover your mortgage, spend less than 10 hours a week on the business, and hit particular revenue targets.

How do you actually get access?

Access is fairly straightforward. You fill out a relatively quick application process. There are two versions of this, for reasons we are not fully clear on:

- A short version – 11 questions, which take 3 or 4 minutes to answer.

- A longer version – 26 questions, which take roughly 10 minutes to answer.

The process currently runs through Typeform, gathering basic information such as name, company name, URL, location, incorporation status, contact details. The ‘longer’ version asks open questions like ‘What’s your story? What do the next 4 years look like?’, ‘What are 5 other companies you’d compare yourself to?’ – these questions then drop into a little more detail around how you acquire customers, how you work to retain them, what your margins are like, whether you’re interested in being connected to potential buyers (ie, companies who may wish to buy yours), what’s your average monthly revenue, and a few more. As mentioned, these are in a typeform, so it’s a little difficult to prepare for this. For that reason, here’s the complete list of questions as we felt this would be useful for anyone thinking about applying:

- What’s your full name?

- Company Website

- Company Name

- Where is your business located?

- What is the incorporated status of your business?

- What’s the best email to reach you at?

- Fantastic, what’s your mobile phone number?

- We’d like to get to understand some of the challenges you’ve faced or you can skip these and your story

- Do you want to want to skip them?

- What’s your story?

- What are 5 other companies you would compare yourself to? (websites are ok)

- What is the biggest challenge you are facing when it comes to building traffic, social media, paid ads, referrals, word of mouth ie: growing your customer base?

- What is the biggest challenge you are facing when it comes to inventory, sourcing, supply chain, logistics ie: areas that impact your margins?

- What’s the biggest challenge you are facing when it comes to engaging and building repeat customers ie: retention?

- What’s your biggest challenge when it comes to choosing agencies, consultants or other companies that claim they can help your business grow?

- Are you interested in being matched to potential buyers?

- Are you interested in being matched to potential Investors?

- Are you interested in optimizing ‘s Supply Chain? Are you interested understanding how benchmarks against your peers?

- Are you interested in knowing the right tech decisions for your business using data-driven introductions and recommendations?

- Are you interested in being matched to potential Marketing Agencies?

- What % of your revenue comes from wholesale?

- Are any of the items items above valuable enough that you’d pay for them?

- Confirm the categories that your business operates in

- Confirm your business model (DTC, Retail, Wholesale, Marketplace, SaaS, Mobile App, Other)

- What is your average monthly revenue, in the PAST 3 MONTHS? (<$1000 – $500k+)

- Do you have an invite code? (the invite code puts you front of the line for assessment basically)

Clear integrate with Shopify, BigCommerce, and numerous other systems.

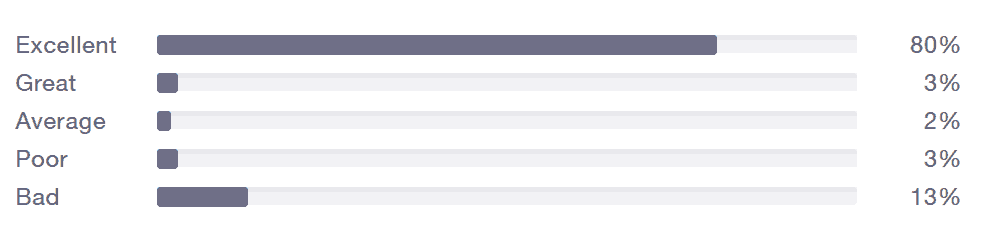

At the time of writing, they’re 80% positive on TrustPilot (with around 170 reviews total).

The vast majority of these are ‘so easy!’ type reviews – saying how simple it is to hook up systems like Shopify & get the ok for the funds. Some compare ClearAngel to Shopify Capital, for example this one, which also highlights a particular member of staff:

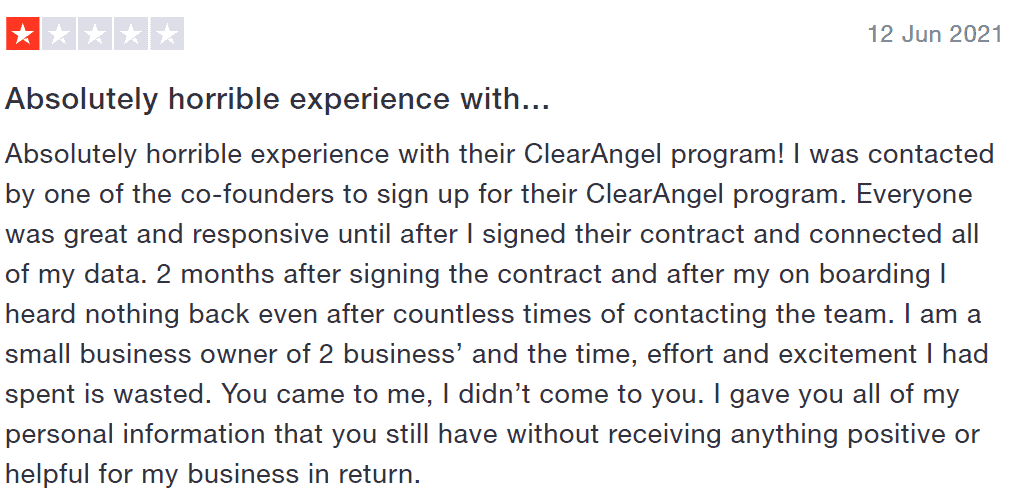

Where there are negative reviews they tend to fall into 2 groups:

- Complaints that the system doesn’t hook up with particular tech (eg, one saying that they are not compatible with Xero, but that you can upload CSVs)

- Complaints about slow communication.

Here’s an example of a communication complaint. If you’ve ever worked in a startup, you’d likely read between the lines here and realise that this is a ‘teething’ problem: A new product launch that has a ‘white glove’ onboarding system that’s fallen down a bit. Ie, nothing major to worry about, but worth being aware.

Summary

All in all, ClearAngel offers a very useful service in terms of ecommerce startup funding, with the opportunity to scale levels of funding further. The ability to access networks is probably vaguely useful, albeit unlikely to be a game changer for many. The possibility to put you in touch with potential business buyers might be a game changer. The levels of funding are $10-25k initially, and this relies on you hooking up your systems so that they can take a look at your current levels and where you’re likely to be headed. For some, that may seem a poor alternative to a conventional loan, for others it will be a real lifeline. The level of payback is dependent on results and, crucially, is ‘non-dilutive’, meaning you don’t have to give away equity. For many, we suspect running the numbers on that will mean you end up better off, presuming your will is to grow an ecommerce business quickly over the next few years with a view to a potential exit.