As ecommerce has evolved, so has the choice and variety of payment methods available to retailers and customers.

From the more regular debit and card payment options, there are now lots of digital wallet options, mobile friendly payments like Apple Pay, as well as a lot of variation between different markets.

In this post we’ll round up some of the latest ecommerce statistics on online payment trends, to see which options are popular, and which are gaining ground.

Stats from Statista show the popularity of various payment methods around the world, based on share of transaction volume.

The data shows the increasing popularity of digital wallet options (Apple Pay, PayPal etc), which can be particularly useful for speeding up mobile transactions.

Much of this growth is coming from the APAC region, where mobile is often the most popular way to shop online.

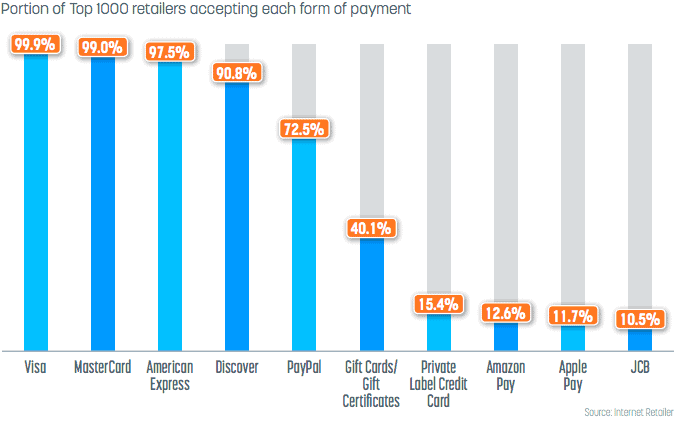

Payment options accepted by major ecommerce sites

Stats from Internet Retailer show that, with the exception of PayPal, adoption of digital wallet methods isn’t yet widespread.

Payment methods by country: Europe

Within Europe, there are a variey of payment preferences for retailers to consider when they’re selling in different markets.

For example, while debit and credit card payments are the most popyular methods in many countries, German online shoppers prefer ELV (a kind of bank transfer method) while many Russian shoppers opt for QIWI, a digital wallet.

World’s largest mobile payment platforms

The mobile payments industry is driven by high usage in Asia, with Chinese tech forms Alipay and WeChat Pay dominating the market.

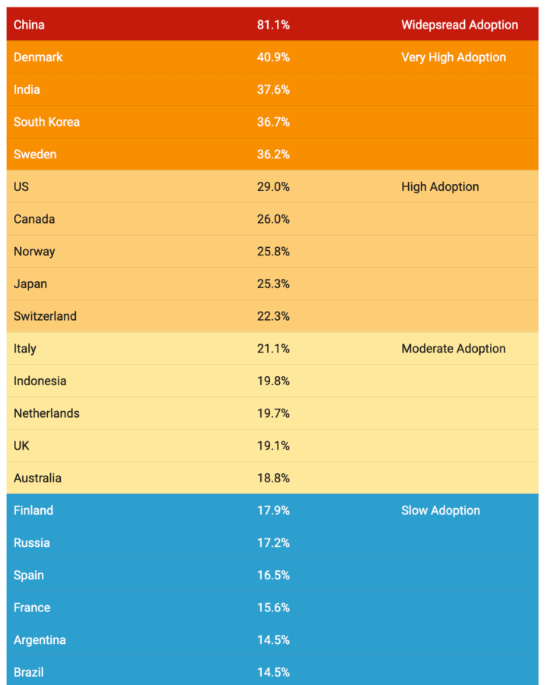

Mobile payment adoption by country

According to eMarketer stats, Chinese adoption of mobile payments outstrips the rest of the world.

81.1% of smartphone users in China use mobile payment options, compared to 29% in the US and 19.1% in the UK.

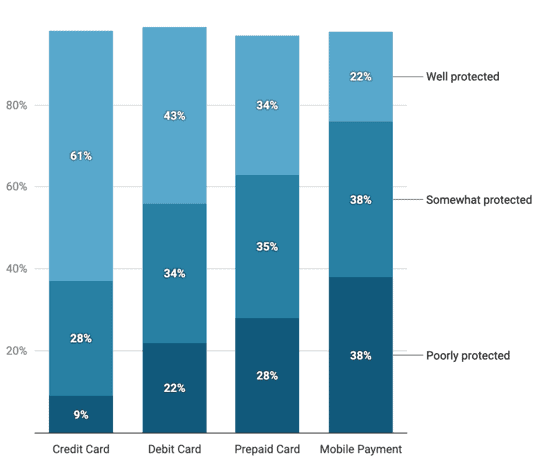

Security concerns about mobile payment options

Consumers still have concerns about mobile payments, and this has held back adoption to some extent.

A survey from Pew found that respondents were more likely to think that mobile payments were poorly protected (38%) compared to debit (22%) and credit cards (9%).